- Let's get you insured.

Plant and Machinery Insurance

Quick Quote

Same-Day Coverage, Your Way

What is Plant and Machinery Insurance

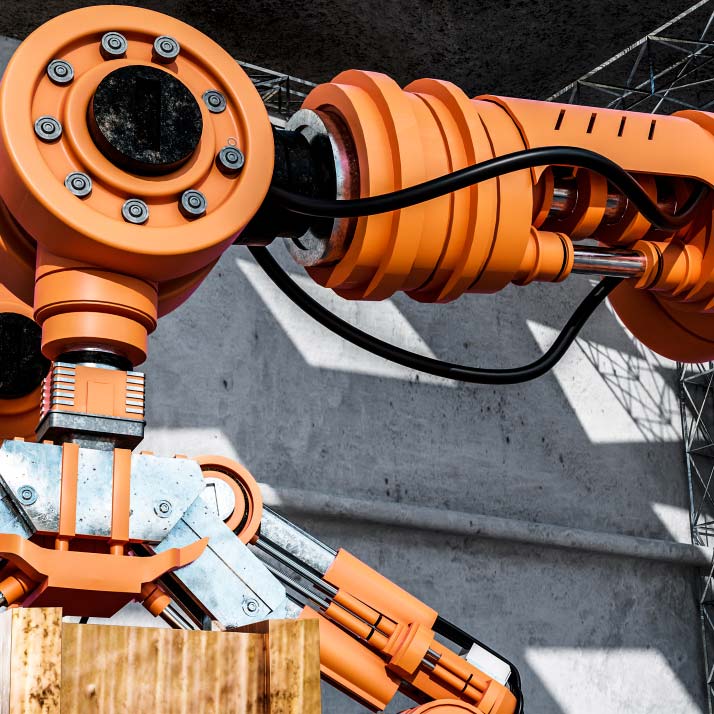

Plant and Machinery Insurance is a crucial type of cover for businesses that utilise heavy equipment in their operations. This insurance can provide protection against unforeseen circumstances like accidental damage, theft, and machinery breakdown, and can ensure that your business operations are not hindered.

In industries such as construction, manufacturing, or farming, heavy machinery plays a pivotal role in the overall productivity and efficiency of the business. Because of this, any unexpected machinery breakdown or damage could lead to significant operational delays, financial loss, and potentially even legal liabilities.

Plant and Machinery Insurance is designed to mitigate these risks. It can provide financial cover for the repair or replacement of insured machinery, usually including the costs of dismantling, transit, and installation. More comprehensive policies may also provide cover for business interruption losses, such as loss of profits or increased working costs, resulting from machinery damage.

Apart from the financial cover, plant and machinery insurance providers often offer technical support and risk management advice to help minimise machinery-related incidents. This support can be invaluable in enhancing the longevity and reliability of your machinery, improving the overall operational efficiency of your business.

Despite its importance, Plant and Machinery Insurance is often overlooked by businesses, especially smaller ones. This is usually due to misconceptions about the cost and complexity of the cover. However, when considering the potential financial implications and operational disruptions caused by uninsured machinery damage, the importance and value of Plant and Machinery Insurance become undeniable. Ultimately, it can provide not just financial support, but also peace of mind for businesses reliant on heavy machinery.

At Machine Cover, we offer comprehensive insurance for your plant and machinery and are just one call away. Our team will work with you to find the best cover for what you need and can even place the cover the same day with a range of flexible payment options so you can have peace of mind!

Why Choose Us For Your Plant and Machinery Insurance

Preventive Measures Guidance

We offer advice on preventive measures to help you reduce risks and prolong the lifespan of your plant and machinery.

Comprehensive Coverage

Our plant and machinery insurance covers not only damage or loss due to accidents but also from natural disasters, theft, and third-party liabilities.

Expertise in

Agriculture

With years of experience in the agricultural industry, we understand the unique insurance needs of plant and machinery better than anyone else.

Fast and Hassle-Free Claims

Our efficient claims process guarantees a hassle-free and swift settlement.

24/7 Customer Service

Our dedicated customer service team is available round the clock to assist you with any queries or issues.

Affordable Rates

We offer competitive pricing without compromising on the quality of coverage.

Trustworthy

Trusted by thousands of businesses nationwide, we are committed to providing reliable protection for your plant and machinery.

Customisable Plans

We offer flexible insurance plans that can be tailored according to your specific requirements and budget.

Are YOU In One Of These Industries?

- Construction

- Demolition

- Landscaping & Earthmoving

- Mining & Quarrying

- Civil Engineering & Infrastructure

- Agriculture & Farming

- Forestry & Logging

- Pipeline & Utility Installation

- Waste Management & Recycling

- Transport & Logistics (Rail & Roadworks)

If you answered yes to any of them, you may need plant and machine insurance

Types Of Plant Machinery Insurance?

When insuring plant machinery, it’s important to consider different types of coverage to protect against a range of risks and liabilities.

1.

Liability Insurance

Covers damages or injuries caused by your machinery while in use, protecting you from legal or financial responsibility.

2.

Property Insurance

Protects your plant machinery against theft, fire, vandalism, or accidental damage, keeping your valuable assets secure.

3.

Equipment Breakdown Insurance

Provides coverage for repair or replacement costs if your machinery suffers mechanical failure or malfunctions.

4.

Business Interruption Insurance

Helps cover lost income if your operations are disrupted due to an insured event affecting your machinery, safeguarding your broader business operations.

Our 4 Step Process To Getting Your Plant Machinery Insurance

Step 1:

Assess Your Equipment Needs

Start by identifying the machinery you need to insure and the level of coverage required. If you’re unsure, our team can guide you to find the right plant machinery insurance.

Step 2:

Speak With Our Expert Team

With our in-depth knowledge of the insurance market, we’ll help you find insurers that offer the best coverage at competitive rates.

Step 3:

Compare Quotes and Coverage

Once your details are collected, we provide multiple quotes from trusted insurers so you can easily compare coverage options and pricing.

Step 4:

Select the Best Policy

We’ll assist you in finalising the paperwork and ensure a smooth transition to your new plant machinery insurance policy, giving you peace of mind.

Frequently Asked Questions

Plant and machinery insurance typically covers physical loss or damage to equipment and machinery used in business operations. This can include coverage for fire, theft, accidental damage, and natural disasters. At Machine Cover, we can ensure that your valuable assets are protected, helping you minimise downtime and financial loss.

Machinery insurance is designed to protect businesses from financial losses resulting from the breakdown or damage of machinery. It covers repair or replacement costs and can include additional expenses such as business interruption and extra operational costs. Machine Cover offers comprehensive machinery insurance tailored to your specific needs, ensuring continuous operation and financial stability.

The type of tractor insurance you need depends on how you use your tractor. For commercial use, comprehensive coverage including liability, collision, and theft may be necessary. For personal or hobby use, a more basic policy might suffice, but liability coverage is still recommended to protect against potential claims.

Plant and machinery refer to the equipment, tools, and machinery used in various industrial, manufacturing, and construction activities. They are vital components of a business’s operational infrastructure. Machine Cover provides insurance solutions to protect these essential assets, ensuring your business can operate smoothly and efficiently.